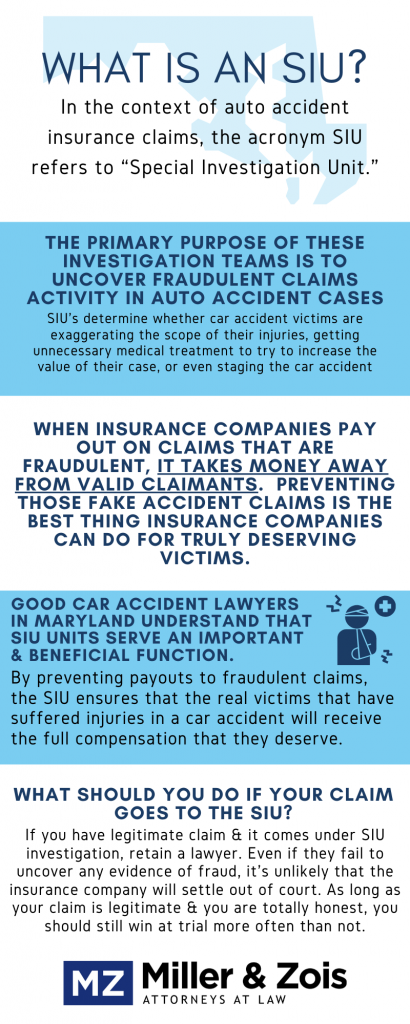

In the context of auto accident insurance claims, the acronym SIU refers to “Special Investigation Unit.” All the big auto insurance companies have an SIU of some type. The primary purpose of these investigation teams is to uncover fraudulent claims activity in auto accident cases.

The Special Investigation Unit (SIU) is a specialized division within insurance companies tasked with investigating claims that may involve fraud, misrepresentation, or other irregularities. Their primary responsibility is to protect the insurer’s interests by conducting in-depth investigations.

The role of the SIU is to identify and investigate claims that may be fraudulent or otherwise merit further examination. This can include claims that involve unusual circumstances, excessive or unrealistic damages, or inconsistencies in the documentation or evidence provided by the claimant.

If an insurance company believes a claim may be fraudulent, it will typically refer the case to its SIU for further investigation. The SIU will then conduct a detailed examination of the case, gather additional information and evidence, and determine whether sufficient evidence supports the claim.

Insurance companies seem to think auto accident claim fraud is widespread and pervasive. I disagree with this view as to how prevalent claims fraud is. However, there is no dispute that many car accident claimants either exaggerate their injuries or even make them up entirely.

Insurance companies seem to think auto accident claim fraud is widespread and pervasive. I disagree with this view as to how prevalent claims fraud is. However, there is no dispute that many car accident claimants either exaggerate their injuries or even make them up entirely.

What is an SIU?

In the world of insurance injury claims, “SIU” means “Special Investigation Unit.” Almost all insurance companies have special investigation units (SIUs), although the actual name of the unit may vary depending on the insurer. The core purpose of SIUs is to root out fraudulent injury claims. The SIUs seek to determine whether victims in car accident cases are exaggerating the scope of their injuries, getting unnecessary medical treatment to try to increase the value of their case, or even staging the car accident. As GEICO explains, the goal of an SIU is “to detect, deter, and defeat insurance fraud.”

The primary duties of an SIU include conducting investigations into claims that have been identified as potentially fraudulent or suspicious, gathering and analyzing evidence, interviewing witnesses and claimants, and working with law enforcement agencies to prosecute fraudulent claims. They also work to identify trends and patterns of fraudulent activity and to develop and implement strategies to prevent fraud from happening in the first place.

SIU investigations may involve a wide range of insurance products, including health insurance, life insurance, auto insurance, and property and casualty insurance. They may also involve a wide range of fraudulent activities, including false claims, staged accidents, and identity theft.

Good car accident lawyers in Maryland understand that SIU units serve an important function and are beneficial. Why? Because ridding the system of fraudulent accident claims leaves a larger pie – and a more differentiated pie – for people who suffer legitimate injuries in car accidents and deserve full compensation. When insurance companies payout on fraudulent claims, it takes money away from valid claimants. Standing and fighting against fake accident claims is the best thing insurance companies can do for truly deserving victims.

What Is the Goal of SIU?

In my own practice, it has been years since any of our auto accident cases triggered an SIU investigation. The reason for this is simple. We are selective about the type of car accident cases we take. Absent compelling circumstances, we do not take auto cases involving only “soft tissue” injuries. Why? Because soft tissue injuries are highly subjective. These are exactly the types of injuries that tend to invite exaggeration and fraud. Moreover, juries are keenly aware of this fact and tend to view subjective, soft tissue injury cases with a high degree of skepticism.

This is why most SIU investigations involve claims based on soft tissue injuries. If you have a case under SIU investigation, the best way to handle it is by being proactive. Taking a “wait and see” approach can be a big mistake regarding SIU investigations. The best strategy is to confront the issue head-on. If possible, contact the SIU investigator to discover why they are suspicious. Then do your own investigation of the claim and provide additional information that might help clarify some confusion and assure the SIU that your client is being honest. If your investigation reveals strong suspicions of fraud, you should probably withdraw from the case.

What Should I Do If There Is an Insurance SIU Investigation?

Are things more complicated if SIU is involved? Of course. Here are some thoughts on how to handle an SIU insurance investigation after an accident.

Seek Legal Representation

One of the first steps to take after an accident is to consult with a skilled personal injury attorney if you have an injury claim. An attorney can be your advocate throughout the claims process, including dealing with the complexities of an SIU investigation. They will ensure your rights are protected and that you have the support you need. In a second, we will talk about honesty and transparency. If you have committed a crime in how you have handled your claim – or you don’t know if you have – you really should call a criminal lawyer. Keep in mind that SIUs are not law enforcement officers. They do not have the power to arrest you or search your property and you have the right to right to refuse to speak to an SIU investigator (keeping in mind that could be a breach of contract if the SIU is your own insurance company).

Prioritize Honesty and Transparency:

Assuming you are not concerned about your criminal liability, be honest with SIU. Be transparent and provide accurate information regarding your accident and injuries. Misrepresentation can have serious consequences, potentially leading to the denial of your claim.

Document Everything

It’s essential to maintain thorough records of all interactions with the insurance company. This includes keeping records of phone calls, emails, and any written correspondence. Keep detailed records of your medical treatment. This should encompass medical bills, prescriptions, doctor’s notes, and any other relevant medical documentation. These records substantiate the extent of your injuries and the care you’ve received.

Interesting GEICO Perspective

One thing I found of interest in writing this post is GEICO’s advice on dealing with potential fraudulent claims. They tell their insureds to “look out for large, older vehicles with three or more occupants.” This sounds a bit like profiling to me. Should we also be on the lookout for poor people? I mean, it might be statistically true, but it seems a little ill-advised to point this out.

Besides, do they really think someone will drive around keeping an eye out for crowded “older vehicles” and then steer clear of it to protect their insurance company from claim fraud? Shouldn’t GEICO advise people to focus on driving safely rather than encouraging them to make irrational decisions based on irrational paranoia? It really makes you wonder who is writing this garbage for GEICO.

And, if you have a meritorious claim assigned to GEICO’s SIU, just file suit. GEICO will never make you a reasonable offer in those cases if my experience is any indication. If you have an explanation, save it for GEICO’s in-house defense lawyer assigned to the case, which is far more likely to have an open mind than the insurance claims adjuster.

What to do if your claim goes to SIU?

If you bring a fraudulent auto accident claim and it gets flagged for SIU investigation, I would strongly advise you to drop your claim and go away as quickly and quietly as you can. If the SIU investigation uncovers evidence, you could face criminal fraud charges. Not to mention the fact that you are hurting a lot of innocent victims who have legitimate claims. If you have a legitimate claim that comes under SIU investigation, you should retain a lawyer immediately. Even if the SIU investigation uncovers no evidence of fraud, it is doubtful that the insurance company will settle your claim out of court. They will almost certainly take the case to trial hoping that the jury will have the suspicions that prompted the SIU investigation. As long as your claim is legit and you are totally honest, you should still win at trial more often than not.

Maryland Accident Lawyer Blog

Maryland Accident Lawyer Blog